The emergence of the DEX decentralized exchange makes the trading of digital assets reliable and far from the mercy of centralized forces, and with the enrichment of the DEX ecosystem the user's choice becomes large for the convenience of DEX, reducing the search cost of products and tools demand has become an immediate need.

It can be roughly understood that DEX is an independent portal, and DEX aggregator is a Google search engine, which removes those information that we are not interested in from countless Internet information, and shows all the information we need, and the aggregator is an engine that shuttles between DEX.

Nexus found that blockchain users prefer to interact with aggregators rather than individual smart contracts. The more complex the variety of products on the chain, the greater the user demand for the aggregator layer. Building a good aggregator will become enough to become a traffic attraction pop-up.

1. How important are aggregators today?

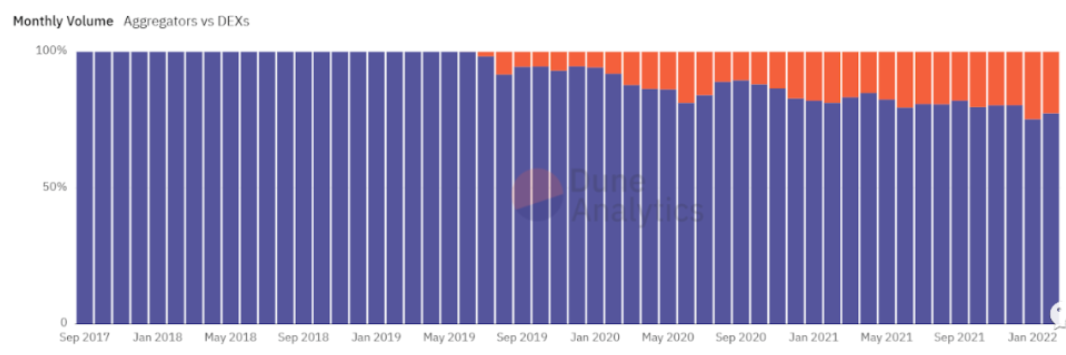

Data shows that about 20% of monthly on-chain transaction volume is generated through DEX aggregators, and there is a clear trend of growth. The reason this number needs more attention is, on the one hand, because aggregators in general represent non-robot trading volume (over 70% of aggregator volume is generated by non-robot traders). On the other hand, it is because bot volume represents about 50% of the total volume traded on the chain, which means that almost 1/3 of the volume generated by the average trader is done through DEX aggregators.

This means that occupying the market of aggregators is equivalent to capturing the immediate needs of the majority of chain users, and properly chain traffic password, Nexus aims at DEX to make a push and direct active traffic to Nexus public chain with aggregation transactions as the selling point.

2.Key Features of Nexus Aggregator

The Nexus aggregator basically performs two simple functions:

Search convenience: the former refers to the fact that in some cases a user may also be interested in buying some tokens that are listed and offered on an exchange he does not use regularly. With the Nexus Aggregator, the user can directly skip the step of repeatedly searching for a place to list a new token and directly purchase any on-chain token.

Execution Quality: The Nexus Aggregator not only helps users find newly listed tokens, but also ensures that any transaction is executed in the best possible way.

For example, when a user delegates an on-chain transaction request to the Nexus Aggregator, the Nexus post-date engine automatically compares, plans, and executes the best exchange path, more often than not directly but with multiple hops, executing the exchange of multiple different tokens to provide the trader with the best slippage and gas fees.

- Core Benefits of Nexus Aggregators

Compared with the general unilateral strategy of aggregators, the advantages of Nexus aggregators are mainly reflected in the engine design. In terms of automatic routing, Nexus aggregators add more liquidity sources, such as RFQ, which is an improvement to the automatic routing technology. In addition, providing lower cost public chains such as Nexus itself and Rollup will also be good for the development of RFQ, and more fierce competition will arise on liquidity sources.

The advantages core experience are twofold:

With Rollup, Nexus aggregators can rely on the faster block finality of the Nexus public chain itself, allowing market makers to quote more frequently and aggressively.

Rollup and cheaper public chain usage costs can create a good positive cycle, increasing on-chain order flow and attracting more market makers through RFQ.

The first point is relatively easy to understand, because the RFQ of Nexus aggregator guarantees 0 slippage, so the longer the order processing time, the higher the risk for market makers, so the quotation of the main chain of Ether will be much more conservative compared to that of Nexus aggregator.

For the second point, once the GAS FEE of Nexus is no longer an issue, it is foreseeable that a large number of end-user oriented applications will connect to the API of Nexus aggregator.

The increasing flow of orders being routed to the aggregator API will create additional incentive for market makers to access RFQ, further optimizing prices and promoting better competition.

In the future, it is likely that most of the manually traded users will use Nexus aggregators to complete their transactions, generating a large number of real, active, quality and precise customers with a willingness to trade for the Nexus public chain, and using aggregators as leverage to pry the whole Nexus public chain ecology.