5ADEX is a brand new DEX3.0 trading platform, 5ADEX innovation subverts the existing DEX AMM model, and directly and effectively solves the existing AMM due to the sharp price decline caused by the loss of funds, and most of the gains are rewarded to 5ADEX liquidity providers in different situations.

5ADEX was born in Europe, developed by the VC Lab technical team, the VC Lab team was formed in 2016, three years of technical precipitation, focusing on the development and innovation of the blockchain field application ecology, and in 2018 involved in the development and research of decentralized transactions, and in 2021 to try to develop a new AMM market maker model, it is planned to launch DEX3.0 version in 2022, subverting the existing DEX AMM market model.

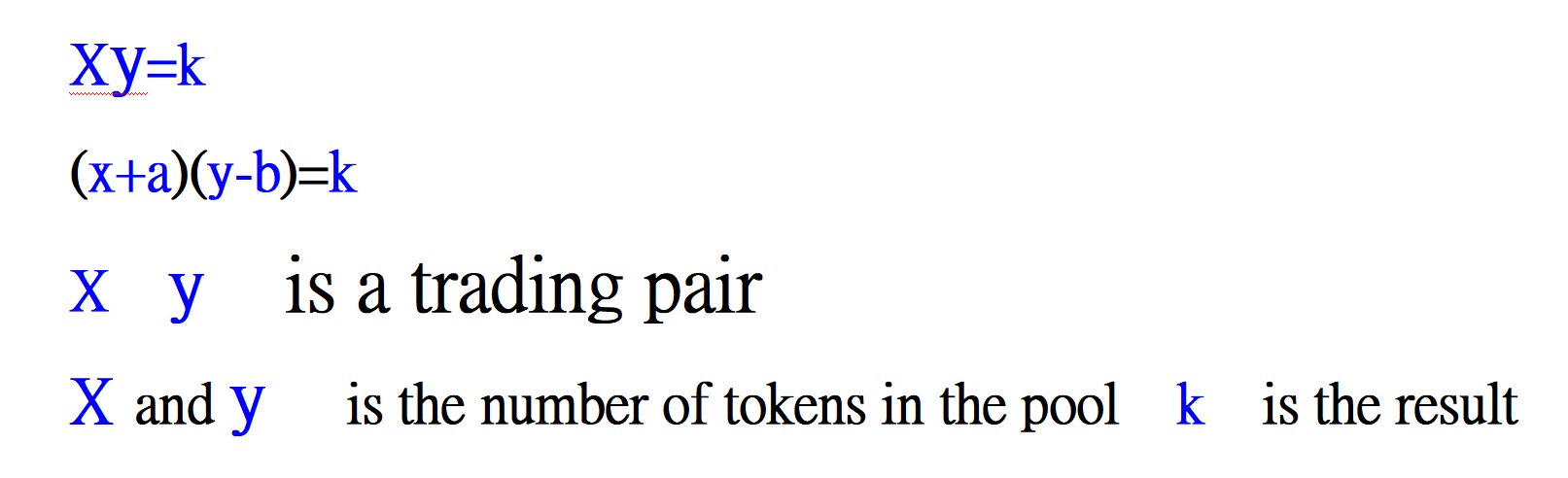

In traditional AMM, take the most classic constant product model (CPMM) as an example, typically Uniswap, cpMM based on the function X *Y=K, which determines the price range of two tokens based on the amount available per token (liquidity). When the supply of token X increases, the supply of tokens of Y decreases, and vice versa to maintain a constant product K.

The AMM mechanism allows anyone to become a market maker, become a liquidity provider, and thus receive the benefits of transaction fees. But this is not a risk-free investment, as there are impermanent losses in AMM, and when the market fluctuates violently, the liquidity provider's assets can suffer losses.

For example, when the token price falls rapidly, the token will deviate from the price during the transaction process, at this time the liquidity provider needs to bear additional losses in addition to the token decline, but this part of the loss cannot be covered by the transaction fee reward, which will hit the enthusiasm of the liquidity provider, resulting in insufficient liquidity of the trading pool, and insufficient liquidity will reduce the user's willingness to trade, resulting in less fee rewards and triggering a vicious circle.

This article will try to explain how 5ADEX reduces the investment risk of liquidity providers in deXT through the design of the 5ADEX AMM mechanism and economic model, and benefits every user in the ecosystem through the deflation mechanism, mainly involving the market maker model, incentive mechanism and deflation mechanism.

5ADEX's technology solutions

5ADEX improves the traditional AMM mechanism, using a variable K value model, which aims to provide more value empowerment for liquidity providers, reduce the risk of users in asset price fluctuations, and then encourage more users to contribute liquidity in 5ADEX, improve the liquidity trading experience, increase trading rewards, and further improve the enthusiasm of liquidity providers.

The advantages of the 5ADEX variable K-value trading model can be seen by the following example:

Suppose that as a liquidity provider in the traditional DEX trading ToKen A/USDT trading pool, ToKen A's current price is 100USDT, and he fills the pool with 100 A's and 10000USDT, according to the CPMM model, the constant K at this time is 1000000; If at this point someone sells 50 A's in the trading pool, then the number of A's will become 150, the number of USDTs will become 6666.67, and the price of A will fall to 44.44 USDT.

Then the total value of the trader's assets at this time is 44.44 * 150 + 6666.67 = 13332.67 USDT, plus the fee income (for the convenience of calculation, ignore it).

If the 5ADEX improved market maker mechanism is adopted, in this transaction, 50 A's will not directly enter the trading pool, but 50% will be directly allocated to the black hole address, and 50% will be distributed to the liquidity provider proportionally, then the number of A's in the trading pool will still be 100, the number of USDTs will become 6666.67, the K value will become 666667, the price of A will be 66.67USDT, and the total value of the trader's assets will be 66.67 * 125 + 6666.67 = 15000.42 USDT, which is 1667.75 USDT higher than the asset value under the traditional AMM mechanism, which is part of the value that 5ADEX brings to liquidity providers.

As can be seen from the above examples, when the token price falls, the assets in 5ADEX show more anti-fall characteristics, which means that for some assets with small market value and large price fluctuations, the trading mechanism of 5ADEX can fully protect the rights and interests of traders and liquidity providers, traders can trade assets at better prices, and liquidity providers do not have to bear the risk of excessive price fluctuations 5ADEX extremely deflationary economic model

In 5ADEX, when the asset is traded, the tokens sold will not go directly into the trading pool, but will be burned by 50% directly into the black hole address, and 50% will be rewarded proportionally to the liquidity provider, which means that as the volume of token transactions increases, the total number of tokens will continue to decrease, tokens will become more and more scarce, and in the case of unchanged market value, the value of tokens will continue to rise Such a trading mechanism applies to all tokens traded in any 5ADEX, including 5ADEX's platform coin 5A itself

The innovative variable K-value AMM model and the deflation mechanism are the two engines that drive 5ADEX forward, and the AMM model reduces the investment risk of liquidity providers and incentivizes them to actively provide sufficient liquidity for 5ADEX; The deflation mechanism allows traders to enjoy the value empowerment brought by token deflation in the trading process, thereby increasing the willingness to trade and bringing more trading income to liquidity providers, and the two mechanisms complement each other to solve the most important liquidity problems in the current DEX.

Official twitter:VC_laboratory Telegram link:https://t.me/Official_Group_5ADEX